Things about Clark Wealth Partners

Table of ContentsMore About Clark Wealth PartnersThe Only Guide to Clark Wealth Partners9 Easy Facts About Clark Wealth Partners ShownThe smart Trick of Clark Wealth Partners That Nobody is Discussing

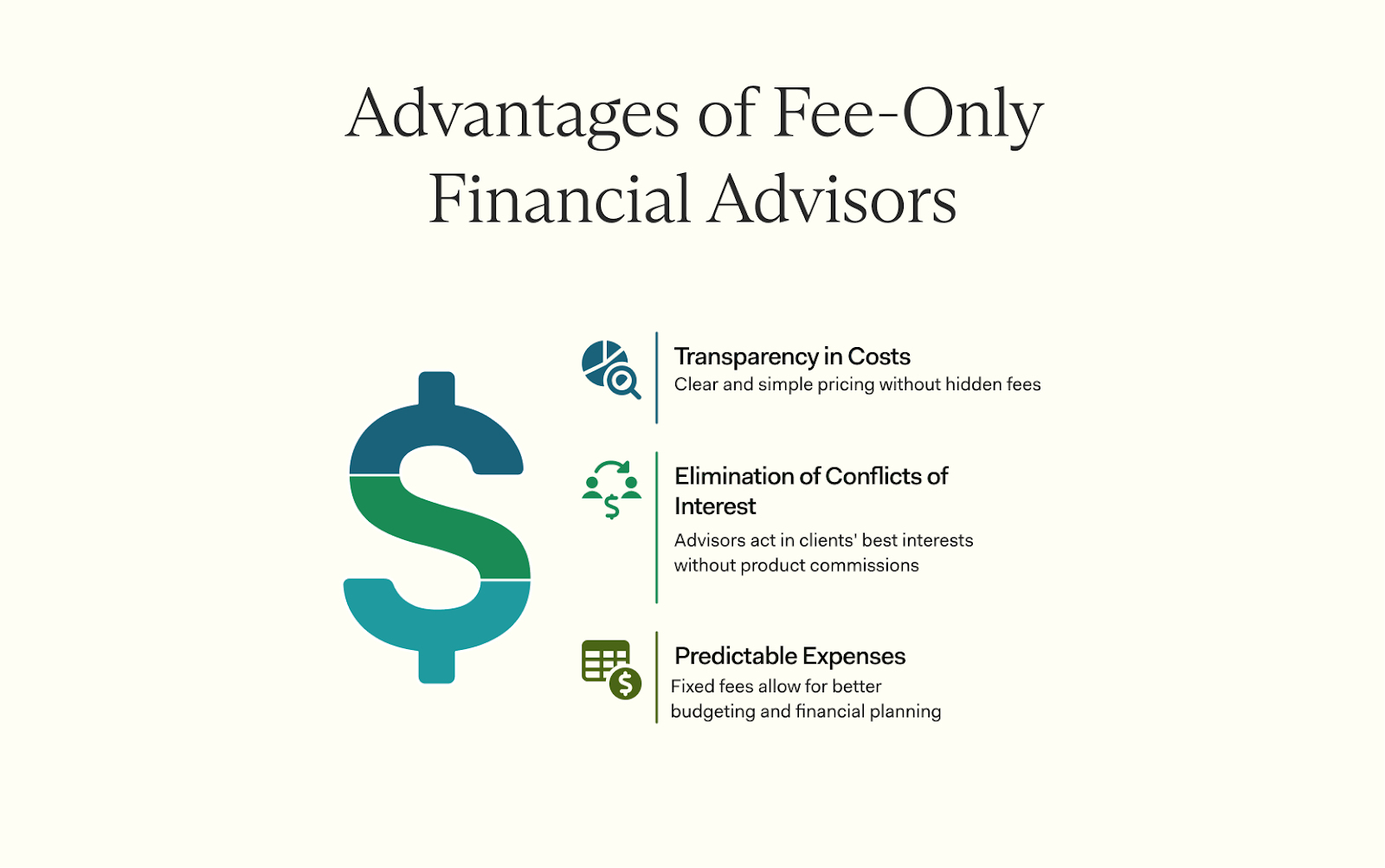

Objective to find a consultant whose charge framework you fit with and with whom you feel you can function with long term. civilian retirement planning. Right here are the pros and disadvantages of hiring a financial expert and the vital points you require to know. Pros Disadvantages Can provide a comprehensive method based on your requirements May have costly and complex charges Can supply clearness and help you stick to your strategy Certifications may be challenging to veterinarian Can deal with portfolio monitoring for you Not every monetary advisor will certainly be the right fit for you Financial consultants concentrate on establishing a thorough approach that can cover lots of aspects of your life, consisting of investment, insurance coverage, estate planning and even moreA great consultant additionally listens to your demands and crafts a technique tailored to your requirements. Show up with your schedule and what you want, he says.

In great times, it's easy to develop a plan and devote to it. When times get hard, individuals often want to depart from a plan that can guide them through and rather choose for what really feels mentally risk-free or protected.

"The most crucial point a person ought to understand prior to involving a monetary expert is that they should pick a fiduciary advisor," says Faro (civilian retirement planning). "As a fiduciary, a consultant is required to give recommendations that is in their clients' best passions, even if that demands suggesting a less costly financial investment option or decreasing a commission," he states

Some Ideas on Clark Wealth Partners You Need To Know

Others charge a fee that's based on the properties they have under management. As a customer, this is something you need total clarity on from your consultant. "It is important to comprehend all costs and the structure in which the advisor operates," states Cast.

Looter: You could conveniently pay tens of thousands over a career. Some financial consultants may have couple of or no credentials, having simply hung up a tile and called themselves an expert. Consumers do have resources to trim down the area before carrying out more study into a consultant. If a consultant advertises qualifications such as a licensed financial planner (CFP) or registered financial investment consultant (RIA), you need to follow up with the CFP Board or FINRA's BrokerCheck or the appropriate organization.

Clark Wealth Partners Fundamentals Explained

"It's usually tough for possible customers to perform proper due persistance on advisors ahead of time, and the industry does a good task of running ads on television and radio that make all firms seem alike, but they are not," claims Kujawa. Below are 5 key concerns to ask any kind of potential economic consultant prior to you start collaborating with them.

"It requires to be the appropriate fit for your house - https://piratedirectory.org/Clark-Wealth-Partners_231760.html." Not all advisors are professionals in every subject, though they might be great generalists (financial advisor st. louis). So you require an advisor that has the knowledge or that can call in various other professionals to do what you require done. Beyond that, the advisor should treat you well, return your telephone calls and normally fulfill guarantees.

The pros and disadvantages, prospective customers need to recognize a selection of things regarding employing a monetary expert, claim the professionals., it's essential to understand what you desire since that will form who you choose.

4 Easy Facts About Clark Wealth Partners Explained

While it can be simple to ignore, your monetary consultant will have access to one of the most delicate areas of your life. That implies exploring any type of possible advisor for fit and making sure they're going to do what you require them to do.